Economics

| Wiki Write-Off Entry | |

|---|---|

| |

| Student Chapter | Makerere University Kampala |

| Competition | December 2014 |

The price of oil has changed greatly over time. This means that price is very volatile and can’t be subject to monopoly. The ever changing prices is then attributed to majorly market forces of supply and demand. This article explains and shows how supply and demand affects the oil price and also elucidates on the global issues affecting the demand of oil, and also explains the supply discrepancies of the oil resource.

The world is a diverse place and its dynamic nature varies greatly with the ticking clock. This implies that classical economic principles that explain demand and supply are being constrained and become greatly limited in explaining the exorbitant issues affecting demand and supply of the oil resource at a global scale.

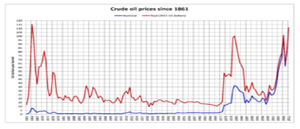

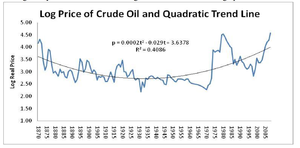

Classical economists defined supply as the amount of a commodity that is readily available for use and demand as the need or desire for use of that particular commodity. It’s important to realize that prices of the oil resource are not set or determined by a particular company, it is subject to market forces of demand and supply. Using this as a baseline, it’s therefore imperative to conclude that this great dependence that price has on market forces is the birth of the global demand and supply issues. Over the past decade, the oil price trends have shown a general decline and this can be attributed to a supply strain as shown in the figure below.

This supply strain is because just like land the oil resource is in fixed supply that means that at any time, there is only a limited amount that can be done readily available under the current technological conditions. Another reason to justify this general decline in prices is the improvement of technology levels for the other energy sources for instance bio energy and solar energy. This has to a minor extent also provided a substitution to the oil resource. To further justify the decline in prices, the cost of production has greatly increased over the past decade due to the fact that the conventional reserves that are easy to produce from are not in existence anymore and companies are going in for very unconventional reserves which are highly capital intensive with a high risk base just like the kashagan field in Kazakhstan.

The oil and gas business is cartel led by the organisation of petroleum exporting countries (O.P.E.C), this cartel has periodic production restrictions in which they dictate how much the countries that adhere to the OPEC can produce. These restrictions can be basing on various factors such as economic climate. The restrictions will cause market deficiencies and affect the price of the oil.

It’s important to also attribute oil price fluctuations to geopolitics of the world. A case study can be pointed out that in the 1930s there was a fall in the oil prices which eventually picked up after World War II. The war caused a disruption in the supply of the oil which caused a market shortage and yet the demand was still high. This can be seen in the graph below.

The oil price fluctuations can also be attributed to the ever increasing world population that according to the United Nations has risen from approximately 350 million in the early 1930s to approximately 7 billion in 2014. This therefore asserts a great demand of the oil resource under fixed supply that results in market shortage that causes the prices to change.

According to the United Nations report on standard of living, the standard of living per house hold has generally increased and this implies that a greater number of people in the world have access to the basic decent living condition. This therefore implies that a greater number of people use oil or its related products and implies that the demand for the oil will increase and this can result in an oil price change.

In light of this great discrepancies it’s also important to acknowledge that the rate of discovery of oil and gas in this present day, does not much up to the world demand. This is a constricted supply trend. This therefore causes a conclusion that due to the ever growing demand and constriction in supply, the effects of this unbalanced condition spirals into a series of actions both legal and illegal. On the legal end, governments and oil companies set policies and tools of administration to counter this strain by placing major checks and balances for instance in Uganda the setup of the Petroleum authority and other regulatory frameworks.

Illegal actions such as hoarding and black market dealings which worsen the market conditions which further cause the prices to be unstable.

With this knowledge therefore, remedies to having a much more predictable and stable oil prices are needed.

See also[edit]

- Economics: fundamental equations for oil and gas property evaluation

- Economics: global supply and demand

- Economics: key parameters

- Economics: time value of money

- Economics of property acquisitions

Sources[edit]

- BP Statistical Review of oil price

- United Nations Population review 2014

- Wikipedia, The price of petroleum

- Macrotrends, Crude Oil Price

- The Energy Collective

- OPEC