Economics: global supply and demand

| Wiki Write-Off Entry | |

|---|---|

| |

| Student Chapter | Makerere University Kampala |

| Competition | December 2014 |

Oil, like any other valuable commodity is subject to the laws of demand and supply. Oil is subject to the law of demand which states that the higher the price, the lower the demand, and vice versa, other things remaining constant. It is important to note that the demand and supply of oil makes it a special resource. Demand refers to how much of a product or service is desired by buyers at various prices. Oil is an example of a good that experiences derived demand. This is one where demand for a factor of production or intermediate good occurs as a result of the demand for another intermediate or final good. Supply is the amount of a product that producers and firms are willing to sell at a given price when all the other factors are held constant.

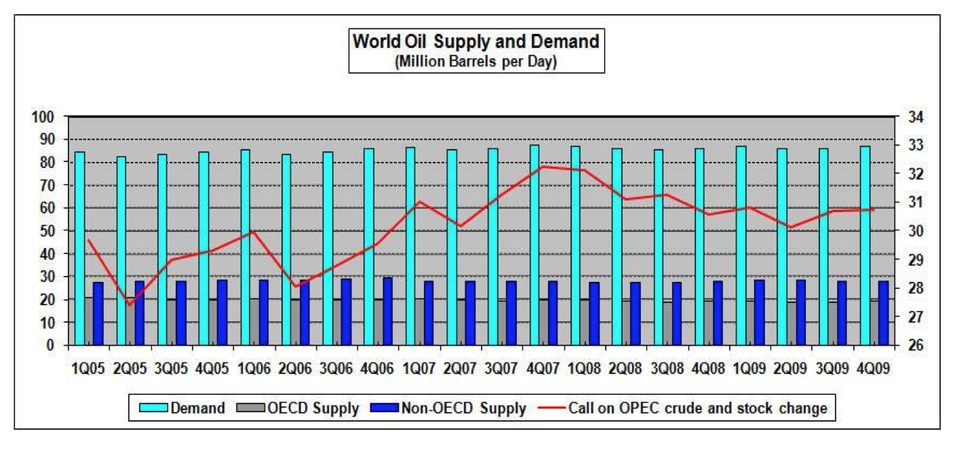

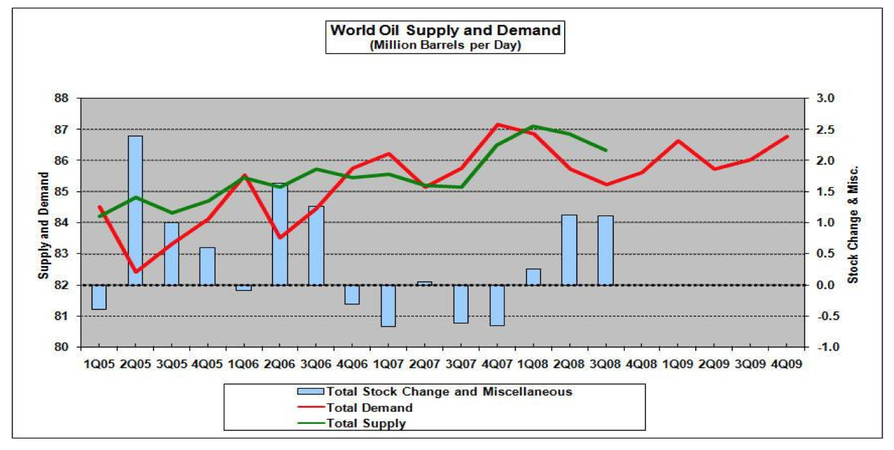

This article discusses the factors that influence the global supply and demand of oil. Oil being a global primary energy source is on high demand and its demand is expected to increase due to the rising world population, increasing levels of industrialisation, among other factors. Oil producing countries such as the OPEC member states are the leading suppliers of oil in the world market, thus changes in their supply policies affect the supply of oil globally. In addition, geo political situations such as the current Islamic Crisis (ISIS) in Syria, Iraq, among others affect the supply of oil. The economic challenges are also a major hindrance to the supply of oil globally which are also emphasised. The contributions from fears and expectations of the oil producers are further discussed.

Introduction[edit]

Oil is found only in certain favourable places, and is an exhaustible resource. The oil may be found in places where it is not readily used thus bringing excess capacity into the global system. In such cases the market forces of demand and supply are not readily applicable.

Oil is one of the global primary energy sources used in all sectors of the economy like manufacturing, and industrialisation, among others. It is a monopoly fuel in the transport industry in the form of diesel, petrol and gasoline. Due to the oil’s diverse use, there is inelastic demand for it in the short run, meaning that changes in price have very little effect on quantity of the good demanded.

As countries develop and industrialize, their oil consumption grows to suit their growing economies. Today China and India are the biggest consumers of oil due to the fast growing economies. Similarly, Developing countries are making steady progress in industrialisation leading to an increase in oil demand. Because oil is such a crucial source of energy worldwide, rapid rises in price spark recurrent debates about the accessibility of global supplies, the extent to which producers will be able to meet demand in decades to come, and the potential for alternative sources of energy to mitigate concerns about energy supply.

The supply of oil is largely dependent on the production of the discovered oil fields within a given time. With new discoveries found in countries such as Uganda, Kenya, and Kazakhstan, the rate of production is expected to increase. In addition, petroleum has a short term price elasticity of supply meaning that changes in prices have a great impact on supply of the oil. It is also important to note that the supply curve of oil can shift unexpectedly and substantially within a given time. Thus the price of oil is volatile.

The geopolitical situation is one of the major factors that affect the supply of oil in a particular region for example the civil war in Libya in 2011 caused a noticeable reduction in oil supply. Worldwide the first oil shock in 1973 brought about the quadrupling of crude oil prices that occurred between October 1973 and January 1974. It was associated with the Yom Kippur War and the Arab Oil Embargo which caused a major scarcity in the world supply. The second oil shock of 1978-81 brought up the tripling of oil prices between October 1978 and October 1981 and was associated with the Iranian Revolution and the Iran-Iraq War, which also brought about shortages in supply. The third oil shock of 1986 led to the collapse in oil prices in 1986 following a major change in Saudi Arabia’s oil policy, which brought about over flooding of the market.[1] Currently, the Islamic crisis (Isis) in Syria has cut the oil production by about 85% due to the significant destruction of energy infrastructure. In addition, the ongoing Russia and Ukraine standoff has brought about a worrying geopolitical situation reducing on the supply of oil.

Another major influence on supply of oil is the production restrictions by the Organisation of Petroleum Exporting Countries (OPEC) on its member states like Libya, Iran, among others, on supply. OPEC's mission is to coordinate and ensure the stabilization of oil markets in order to secure an efficient, economic and regular supply of petroleum to consumers, a steady income to producers and a fair return on capital to those investing in the petroleum industry. It is therefore OPECs responsibility to regulate the oil supply on the global markets to ensure stable market conditions (International Energy Agency, 2007).

The Organisation for Economic Co-operation and Development (OECD) is an international economic organisation that stimulates world trade. It provides a platform to compare policy experiences seeking answers to common problems, identify good practises and coordinates domestic and international policies of its members. By so doing, it influences the global market policies of oil and hence affects demand and supply being a dominant key player.

Expectations and fears by the oil producers in order to optimise profits also greatly influence the supply of oil. These producers may hoard the oil, leading to scarcity in supply, and eventually bring about black markets. In addition, due to the unexpected and substantial shift in the supply of oil, the prices are highly unstable and volatile; hence, the producers cannot determine the market price.

The supply of oil has globally been faced with economic challenges such as difficulty in finding oil especially the easy oil, leaving the option of difficult unconventional oil fields such as the tar sands like those found in Canada. Also, the financial investment in oil production is very high due to the large amount of capital required for development and production of the reservoir. Not many countries and firms can solely take up the task of producing from a given field hence retarding the supply of oil. In addition, the newly discovered oil fields are much smaller with fewer reserves and potential to be produced.

Summary[edit]

The supply and demand of oil is expected to continue growing due to the fast rate of industrialisation, improved technology to discover new reserves, and increasing world population worldwide. With much of Europe in recession and the United States of America oil production rising, the supply of oil is expected to increase. However much new inventions of alternative energy sources are cropping up like biodiesels, the Athabasca Oil Sands, and solar energy, the demand for oil will still rise. Like any other non- renewable resource, nations are expected to use the oil sparingly such that it creates a lasting value on society and also protect the environment from its negative impacts.

See also[edit]

- Economics

- Economics: fundamental equations for oil and gas property evaluation

- Economic geology

- Economics: key parameters

- Economics: time value of money

- Economics of property acquisitions

Bibliography[edit]

- Cassedy, E. S., and P. Z. Grossman, 1998, Introduction to Energy: Resources, Technology and Society, 2nd edition, Cambridge University Press.

- Cavalcanti, T. V. D., V., K. Mohaddes, and M. Raissi, 2012, Commodity Price Volatility and the Sources of Growth: IMF Working Paper WP/12/12

- Kilian, L., 2009, Not All Oil Price Shocks Are Alike: Disentangling Demand and Supply Shocks in the Crude Oil Market: The American Economic Review, v. 99, pp. 1053–1069.

References[edit]

- ↑ Blanchard, O. J., and J. Gali, 2007, The Macroeconomic Effects of Oil Shocks: Why are the 2000s So Different from the 1970s?, National Bureau of Economic Research, working paper no. 13368.

- ↑ 2.0 2.1 International Energy Agency, 2007, Oil market report